Are you considering a career in finance? If so, you may have come across the Chartered Financial Analyst (CFA) designation. The CFA is a prestigious certification that can open doors and provide opportunities for advancement in the finance industry. However, it’s important to weigh the pros and cons before deciding to pursue this designation. In this article, we will explore the benefits and drawbacks of getting a CFA, helping you make an informed decision for your career. Let’s dive in!

Pros of Getting a CFA

- Enhanced Finance Knowledge: The CFA program covers a wide range of topics, including economics, financial analysis, portfolio management, and ethics. By pursuing this designation, you’ll gain a deep understanding of these areas, equipping you with valuable knowledge that can be applied to various roles in finance.

- Career Advancement: The CFA is highly regarded in the finance industry and is recognized globally. Holding this designation can significantly boost your career prospects, as it demonstrates your commitment to excellence and professional development. Many employers prefer or require candidates with a CFA, giving you a competitive edge in the job market.

- Networking Opportunities: Joining the CFA community opens doors to a vast network of professionals in the finance industry. You’ll have access to local and global events, conferences, and forums where you can connect with like-minded individuals, share insights, and build valuable relationships. Networking can lead to job opportunities, mentorship, and ongoing professional growth.

- Salary Potential: The CFA designation is often associated with higher earning potential. According to industry reports, professionals with a CFA earn higher salaries compared to their peers without the designation. As you progress in your career and gain experience, the CFA can contribute to your negotiating power and help you secure better compensation packages.

- International Recognition: The CFA is a globally recognized credential, highly regarded by employers and financial institutions worldwide. If you aspire to work in international markets or for multinational companies, having a CFA can enhance your credibility and open doors to global career opportunities.

Cons of Getting a CFA

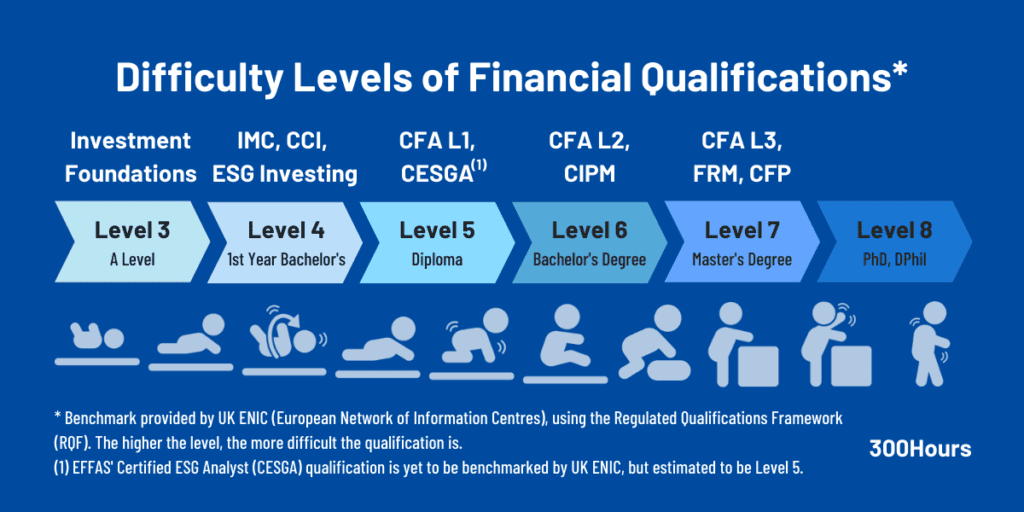

- Time Commitment: The CFA program is rigorous and demands a significant time commitment. It consists of three levels, each requiring months of dedicated study and preparation. Balancing work, personal life, and studying for the CFA can be challenging, especially if you have other commitments or responsibilities.

- Financial Investment: Pursuing the CFA designation involves financial costs. You need to pay registration fees, purchase study materials, and potentially attend preparatory courses. Additionally, there may be indirect costs, such as taking time off work for exams or reducing working hours to accommodate studying.

- Pass Rate and Exam Difficulty: The CFA exams are known for their difficulty. The pass rates for each level are relatively low, requiring candidates to invest substantial effort in preparation. The exams cover extensive materials, and the questions are designed to test your knowledge and analytical skills. It’s essential to be prepared for the challenging nature of the exams and be ready to invest time and energy into studying.

- Continuing Education Requirements: Once you obtain the CFA designation, you’ll need to fulfill continuing education requirements to maintain it. This involves completing a certain number of professional development activities and reporting them periodically. These requirements ensure that CFAs stay updated with industry developments but add an ongoing commitment to your professional life.

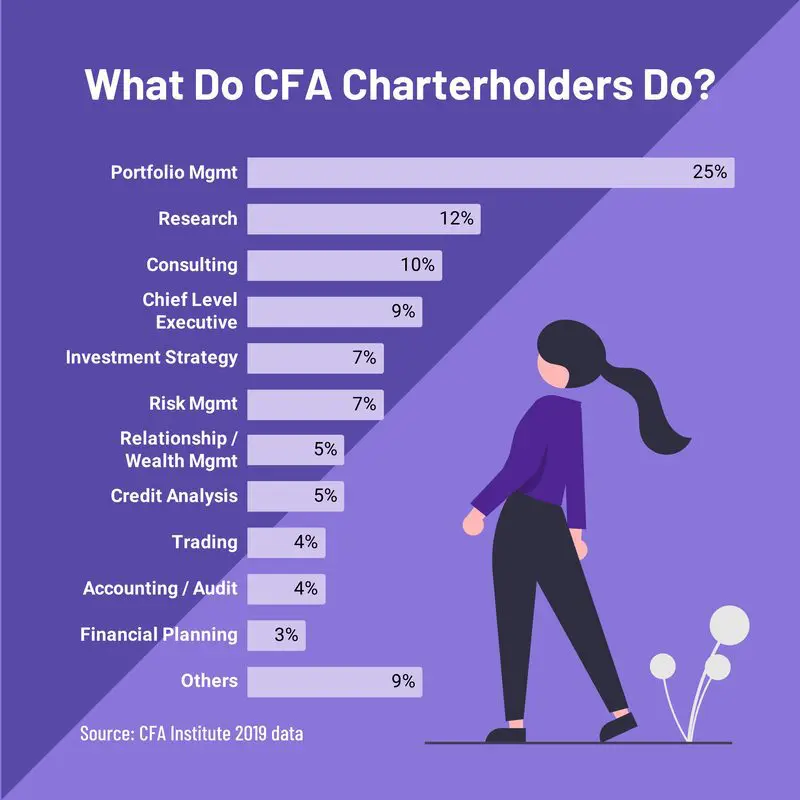

- Narrow Focus: While the CFA program covers various finance topics, it primarily focuses on investment analysis and portfolio management. If your career aspirations lie outside these areas, such as corporate finance or financial planning, the CFA may not be the most suitable designation for you. It’s important to consider your long-term career goals and whether the CFA aligns with them.

In conclusion, pursuing a CFA designation can have significant benefits for your finance career. It provides in-depth knowledge, enhances career prospects, and offers networking opportunities. The CFA is globally recognized and associated with higher earning potential. However, it’s crucial to consider the time commitment, financial investment, and ongoing requirements associated with the designation. Additionally, the CFA’s focus on investment analysis may not align with all finance career paths. By carefully weighing the pros and cons, you can make an informed decision that aligns with your aspirations and long-term goals. Good luck on your journey to becoming a Chartered Financial Analyst!